Operational due diligence (ODD) assesses operational aspects of alternative investment firms, such as infrastructure funds, hedge funds, and private equity funds.

An essential facet of any corporate acquisition is due diligence. Operational due diligence (ODD) can also be used during mergers & acquisitions, investments, or capital raising.

Operational due diligence (ODD) is a process that looks at the operations and business model of the target to make sure it’s a suitable fit for the buyer; ODDs are often undertaken in the industrial sector.

It can also be a process through which a prospective buyer examines the operational facets of a target firm during mergers and acquisitions.

Why Operational Due Diligence?

Analysing synergies between a purchaser and target organisation requires operational due diligence consulting. It is a helpful tool for assisting buyers to jump-start the value creation process in preparation for functional enhancements or integration after the transaction.

Performing internal due diligence is a terrific idea for any firm being purchased.

However, due diligence problems frequently cause agreements to fall through, so if the sell side can handle it before the buy side gets involved, problems may be managed swiftly and quietly.

This might significantly improve the sell-business side’s case, raising the deal’s value. The primary goals of performing operational due diligence are:

- To confirm that the target company’s operating characteristics are correct.

- To provide good cooperation across all target company departments.

- Confirm that the target company has the necessary resources, including funds.

- To save the buyer’s time.

Who is an ODD consultant?

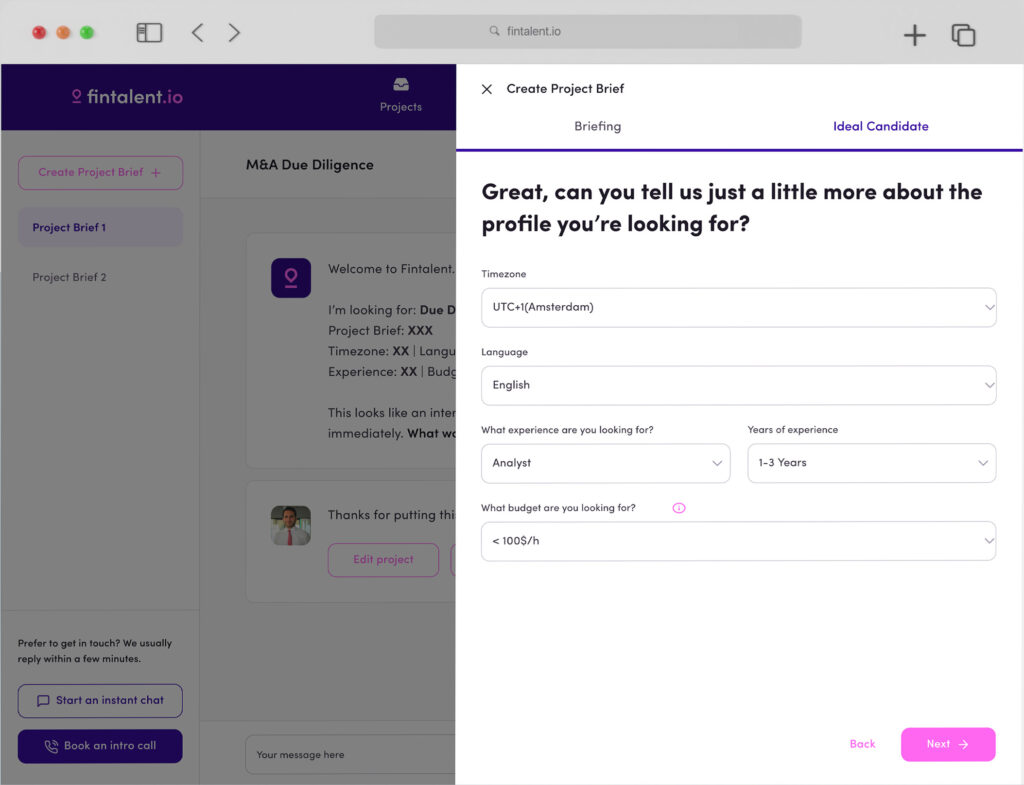

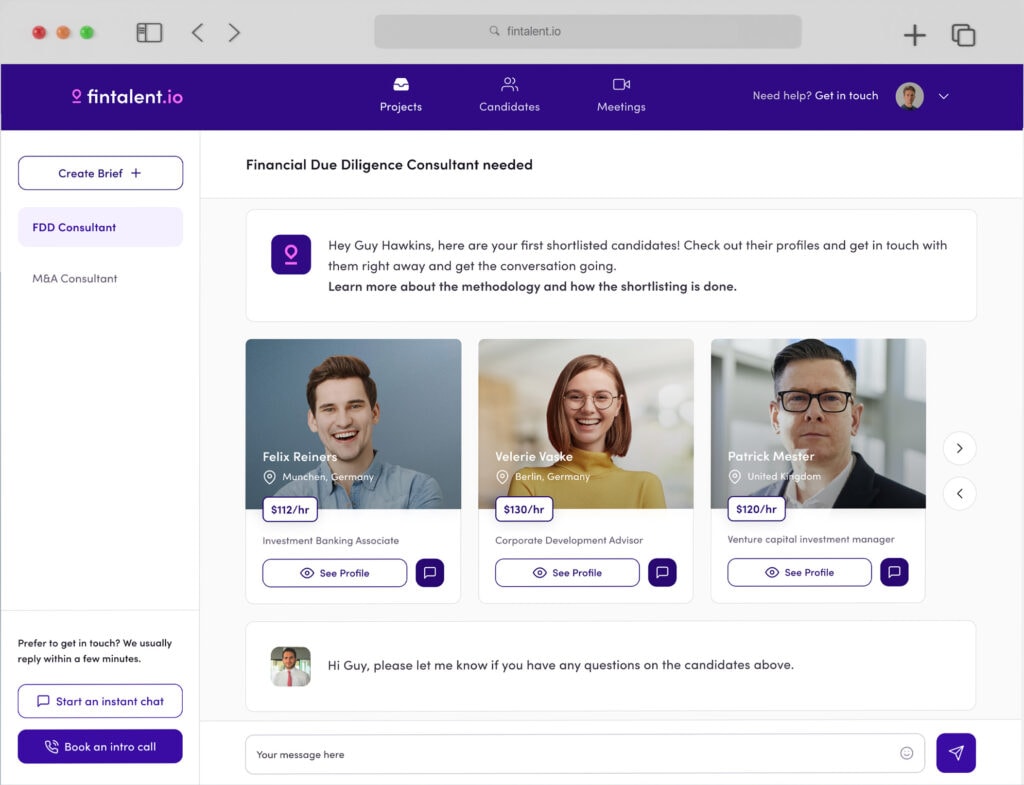

ODD consultants are operational experts that engage with private equity companies to conduct M&A operational due diligence and prospective acquisition estimates.

The operational due diligence experts offer knowledge of the risk and active actions. They provide a plan for enhancing operation capacity and future expansion.

Why ODD Consultants?

Investors and companies intending to buy or invest in a new company must confirm all pertinent information before making the transaction. Many purchasers regularly conduct due diligence at the customer and financial levels, but they require assistance from a due diligence expert specialising in operational due diligence consulting services.

An operational strategy plan is a part of the packages that come with hiring a functional due diligence expert. This strategic strategy provides a road map for boosting an investment asset’s worth.

Also, a strategic plan for operational improvement can help determine the cash flow requirements, capital plan, and general recovery schedule. Only an ODD specialist can accomplish all of those.

Furthermore, Private equity firms concerned about acquisition multipliers may find this helpful. The prospective EBITDA(earnings before interest, taxes, depreciation and amortization) benefits resulting from operational changes may also be displayed to investors using this roadmap.

What does an Operational Due Diligence consultant do?

Operational due diligence consultants assist businesses in converting business predictions into the operational enhancements and integration tasks required to realise them.

On the other hand, they employ fact-based analysis to discover and quantify working capital adjustments, liabilities, risk exposures, and opportunities for finance & accounting, supply chain, and operations, as well as modifications to EBITDA.

Additionally, they identify possible problems early to reduce post-transaction shocks that can impede value capture.

The role of a consultant on the Buy-side:

- Evaluates the target’s operational effectiveness and possible threats.

- Determine cost-saving and synergy opportunities that influence value.

- Make a list of probable obligations and risk exposures.

- Determine the services needed for the transition.

The roles of a consultant on the Sell-side:

- Boost knowledge base, negotiation stance, and sales process management.

- Establish the accuracy of the material in the sales note.

- Actively respond to buyer-related issues and concerns.

Operational Due Diligence Checklist

Operational Due Diligence has a flexible checklist that may be adjusted depending on the circumstances. Internal mergers and acquisitions(M&A) purchases and private equity companies are covered under the list.

Performing operational due diligence during an M&A transaction is daunting, but it’s necessary to conclude a fruitful, just, and effective agreement. A due diligence checklist includes all the data a business needs to get from a target before proceeding with an acquisition.

The due diligence checklist lists categories depending on the business and the buyer. Based on the buyer’s demands, the target company’s evaluation areas will need to be listed.

Examples of Operational Due Diligence Checklist

The following represents a decent operational due diligence checklist:

1. A preliminary analysis of the target company’s activities.

- How closely do the target company’s activities match those of the buyer?

- What overlaps or conflicts do the buyer, and the target firm have?

- What investment will be needed to get the target company’s operations up to the targeted level?

2. Document Analysis.

- Verify internal processes.

- Verify business compliance. Verify necessary licenses and subscriptions.

- Review the technologies supporting operations.

3. Location Visit.

- Make a general evaluation of the business’s current operations (i.e., what would change if we bought it today?).

- What conditions are the technology, equipment, and machinery in the factory, office, and logistics centre?

- Are there any apparent bottlenecks or backlogs at the target company’s location?

4. Projections

- Make predictions about the value addition your organisation can provide using the data obtained up to this point.

- Can the same equipment/technology provide additional value?

- Is having this extra capacity worth anything?

- Create a budget based on the activities of the target firm in collaboration with the commercial and financial departments.

Final Thoughts

A company must be examined to determine the process points that provide value and any flaws that need to be fixed to generate a trustworthy and institutionally feasible investment product.

This is what operational due diligence entails. However, a third-party management consultant is needed to carry out due diligence.

The operational structures of the target would be reviewed from the buyer’s perspective during operational due diligence, and the buyer will learn if the objective has any danger.