What is Strategic Financial Planning?

Strategic financial planning refers to the practice of developing and maintaining a firm’s assets and liabilities, as well as its income and expenses, in order to maximize its potential. Strategic financial planning is a process that organizations use to plan for the planning of their future. A successful strategic financial plan will help in the execution of the company’s strategy in two ways. Firstly, it provides a tool that can be used in all areas of decision-making, which is particularly beneficial in anticipating changing business conditions. Secondly, it allows for the assessment and comparison of different scenarios before taking action.

The most important thing with strategic finance is having an understanding of all the different opportunities available to you through your company’s product or service offering through effective market research and market analysis. This can help identify incentives for investment or where your company needs to focus its efforts over time.

Examples of a suitable strategic financial plan include:

Financial objective for a business

- Identifying costs which are currently being financed and predicting the patterns of future requirements.

- Investing in activities which will help to achieve the business objectives.

- Identifying opportunities for new revenue streams as well as cost savings or areas where greater efficiency can be achieved (i.e., efficiency drive).

- Consider developing investment funds to invest in improving processes and technology to improve efficiency and sales growth (i.e., back office/managed services).

- Identifying future cash requirements for operating cash flow, capital expenditures, income taxes, dividend payments, etc.

Financial objectives for multiple divisions

- Identifying the sources of revenue that are available to divisions or subsidiaries.

- Identifying the costs which are driven by each division’s operations.

- Maximizing efficiencies within each division to minimize costs and maximize revenues while also focusing on identifying opportunities for new revenue streams (i.e., competitive analysis).

- Identifying investment funds to invest in improving processes and technology to improve efficiency and sales growth (i.e., back office/managed services).

- Identifying future cash requirements for operating cash flow, capital expenditures, income taxes, dividend payments, etc.

Financial goals for the organization as a whole

- Establishing goals set of strategic financial objectives of the organization (which may not be fully achievable).

- Making estimates of how much time it will take to achieve these goals.

- Setting up milestones which will be used to monitor progress on the goals (i.e., business plan analysis).

- Developing indicators to measure progress against business plan (i.e., ROI) and identifying incentives that can help achieve these goals (i.e., ROI analysis).

- Identifying investment funds to invest in improving processes and technology to improve efficiency and sales growth (i.e., back office/managed services).

- Identifying future cash requirements for operating cash flow, capital expenditures, income taxes, dividend payments, etc.

Businesses should prioritize their needs for capital by exploring available alternative methods such as using debt or equity financing methods that will enable them to cover their current needs and prepay debts. Companies should also look towards high-yield assets such as real estate which will lead them towards securing an ample source of cash flow. Finally, they should keep their personal tax rate under control so that they can maintain a positive net worth.

A strategic financial planning process should be guided by a set of pre-planned objectives and step-by-step guidelines. It should also be able to incorporate multiple inputs such as external events like competition and other unpredictable matters such as changes in interest rates or an increase in wages. Businesses should also make sure that their financial strategies are sustainable; they should avoid engaging in excessive debt financing methods because this could lead them towards bankruptcy problems.

A firm’s financial plan should be drafted in a manner that will help it maximize its potential. Businesses should consider the various investments that are available for them to secure capital. For example, they can use secured debt financing methods such as borrowing short-term funds that are loaned at a fixed rate of interest. On the other hand, they can also apply for loans that are called “mezzanine” or “non-recourse” which is similar to secured debt financing but there is no prior security. There are also companies that use equity funds to secure funding. Equity means ownership by other means, usually through stock-ownership or partnership arrangements. The equity funds can be used to acquire new assets, pay off debts and reduce cash flow needs.

When a firm incorporates, it should consider which type of legal entity would be best suited to its business needs. For instance, a firm that undertakes the retail trade may want to incorporate as a C Corporation since this will enable it to obtain advantageous taxation treatment. Other legal forms such as partnerships and sole proprietorships can also be utilized as long as they comply with relevant laws and regulations such as the requirement of an established entity like bank or trust company to sign their guarantee. In order for a business to create a solid financial foundation, it must conduct a planning process that will assess various alternatives and weigh their pros and cons.

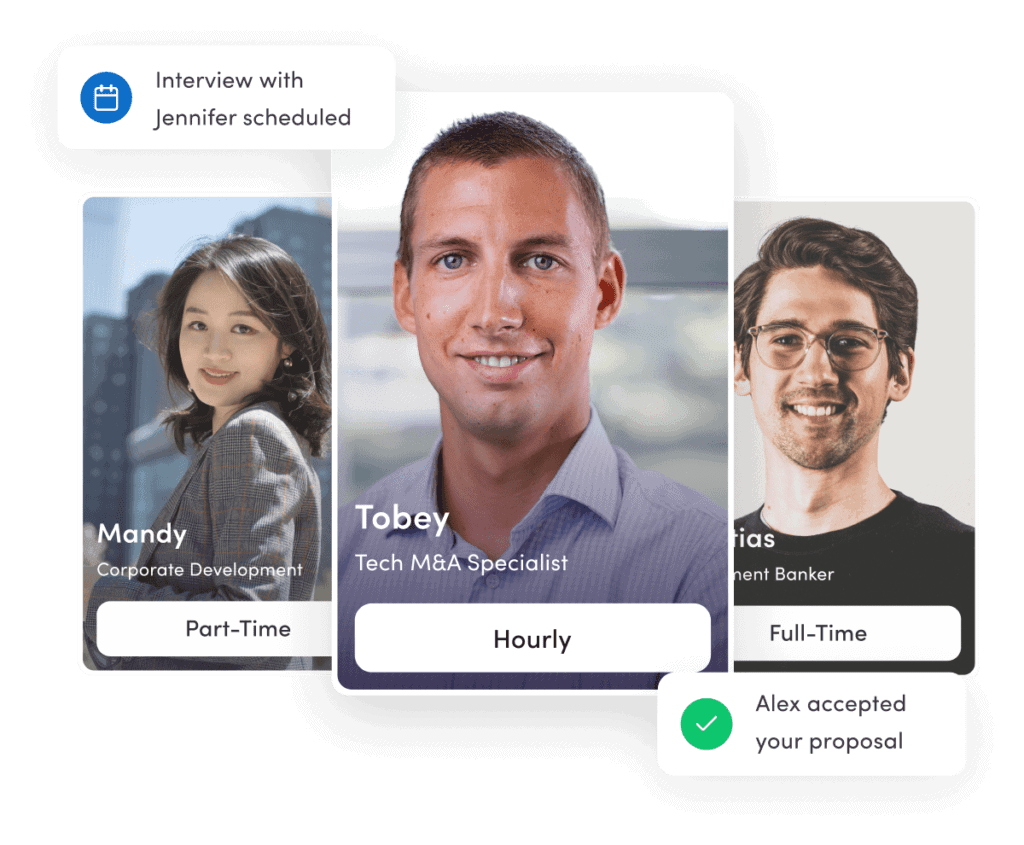

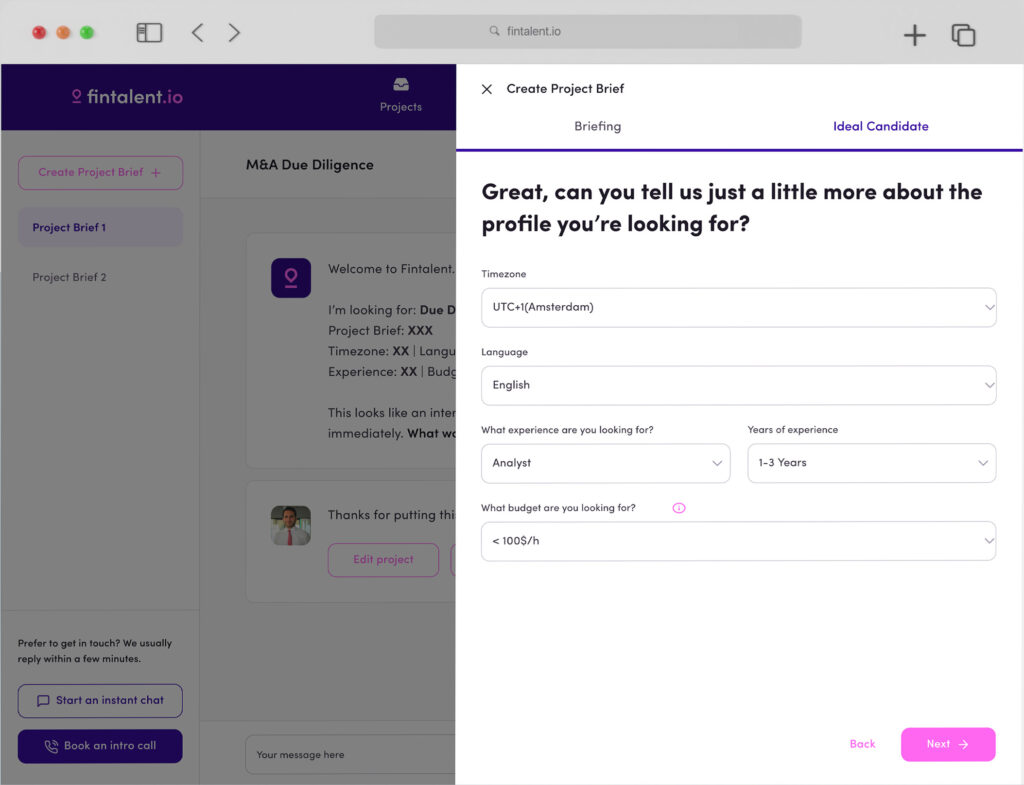

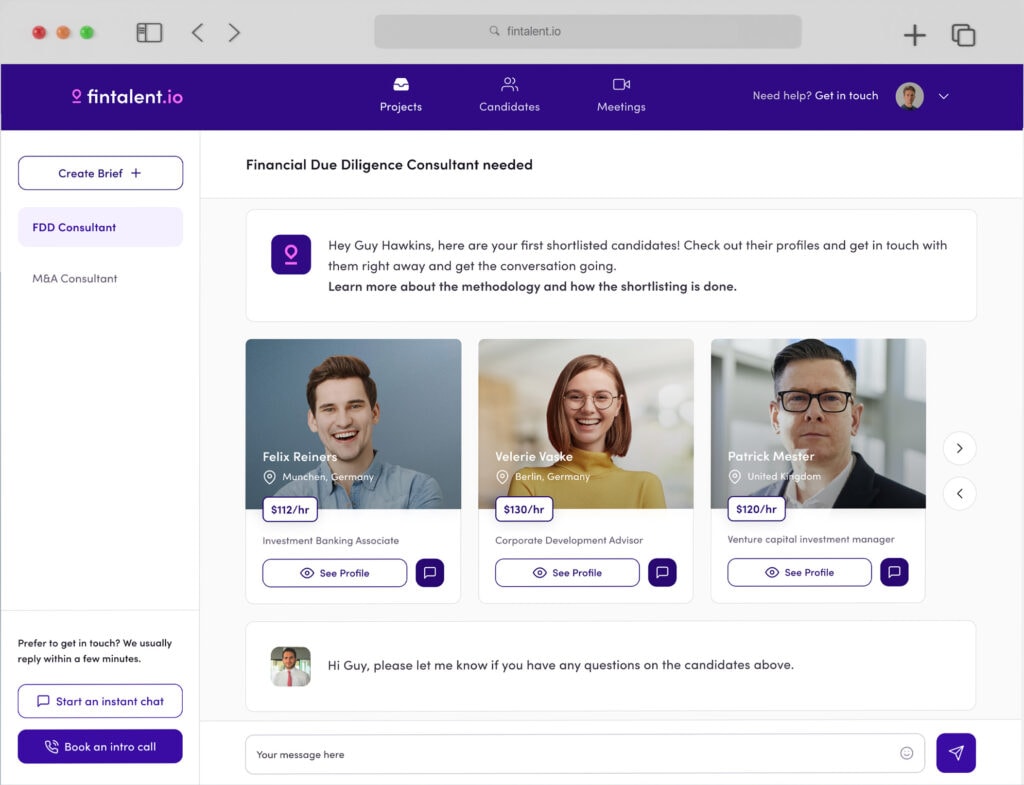

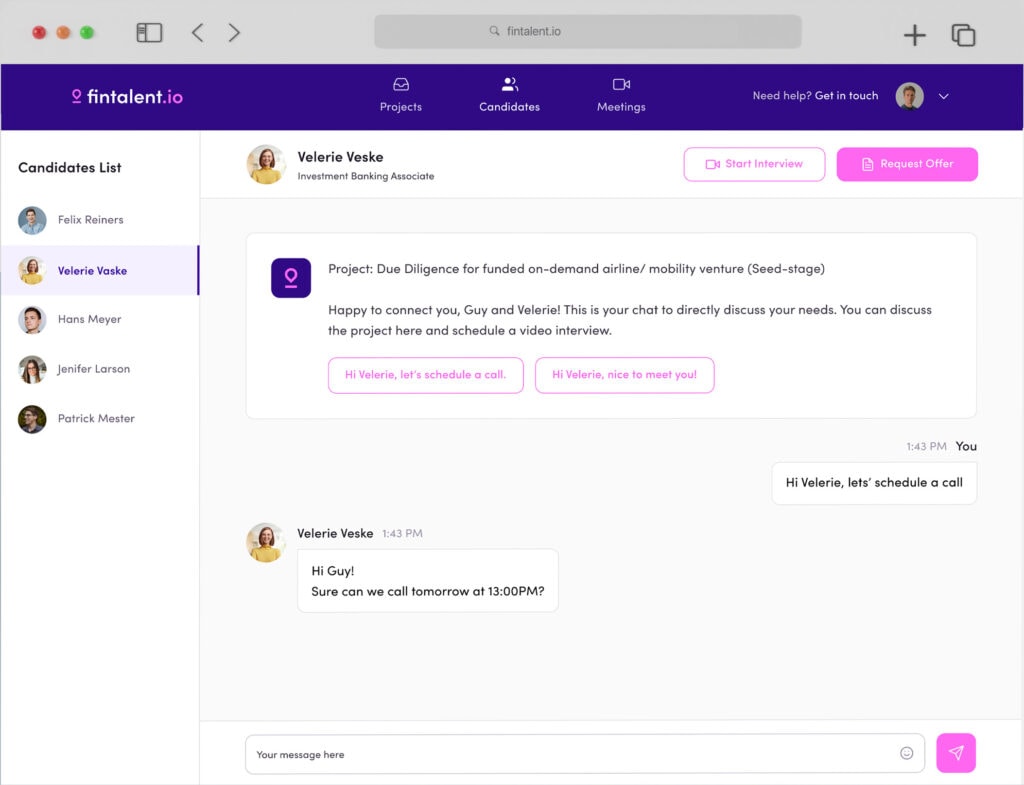

In summary, Strategic financial planning has become a focus area for numerous local and international organizations as it provides one of the most effective means for organizations to achieve their financial goals. Many organisations have structured strategic planning as a key part of their annual/long term strategies by aligning it with strategic objectives, divisional plans and divisional budgets. Tying the various objectives of the entire organization together is key to the actualization of organisational strategic objectives. Managers who find this process excessively tasking can avail themselves of the opportunity presented by Fintalent to hire Freelance Financial Planning and Analysis Consultants, including those specializing in strategic finance consulting, that can help plan and implement an organisation’s strategic financial planning process.