How can M&A facilitate market expansion?

Mergers and acquisitions (M&A) can facilitate market expansion in several ways:

- Expanding the customer base: M&A can help a company gain access to new customers and markets, both geographically and within the industry.

- Acquiring new products or services: M&A allows a company to add new products or services to its portfolio, providing a wider range of offerings to customers and broadening its market presence.

- Synergies and cost savings: By combining operations, companies can achieve economies of scale, leading to cost savings, increased efficiency, and better market positioning.

- Gaining access to new technologies: Acquiring a company with advanced technology or unique capabilities can help the acquiring company to accelerate its growth and expand its market share.

- Competitor consolidation: M&A can help a company eliminate competition and strengthen its market position by acquiring or merging with a competitor.

Why should companies opt for inorganic growth and market expansion through M&A, as compared to organic growth?

Companies may opt for inorganic growth and market expansion through M&A as compared to organic growth due to several reasons:

- Speed: M&A can offer faster growth opportunities by immediately acquiring market share, customers, and assets, compared to the slower process of organic growth.

- Access to expertise: Acquiring a company with specialized knowledge or technology can help a company expand into new markets or enhance its competitive advantage.

- Competitive edge: M&A can help a company eliminate competition and consolidate its market position, which can be challenging to achieve through organic growth alone.

- Diversification: Inorganic growth through M&A can help a company diversify its portfolio, reducing its dependency on a single market or industry.

- Financial benefits: M&A can offer tax benefits and increased access to capital, which can be used to fuel further expansion.

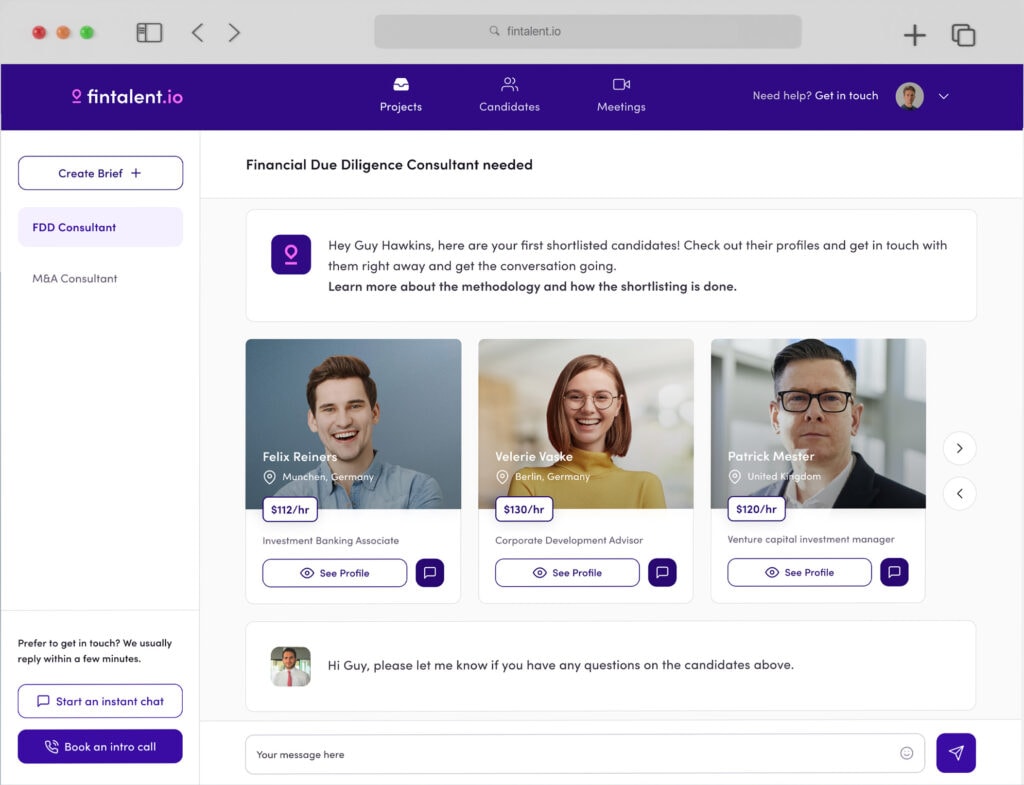

How can an external consultant help with market expansion through M&A?

An external consultant can help with market expansion through M&A in several ways:

- Strategy development: Consultants can help companies identify suitable targets for M&A, determine the potential value of a deal, and develop a strategic roadmap for market expansion.

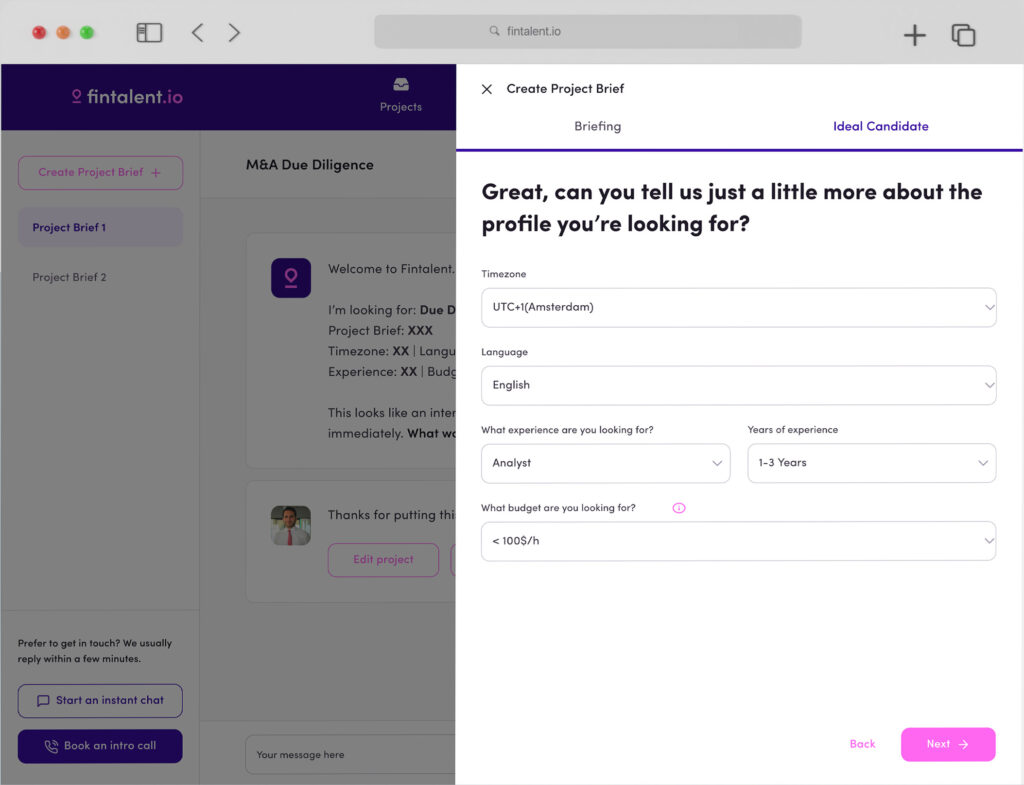

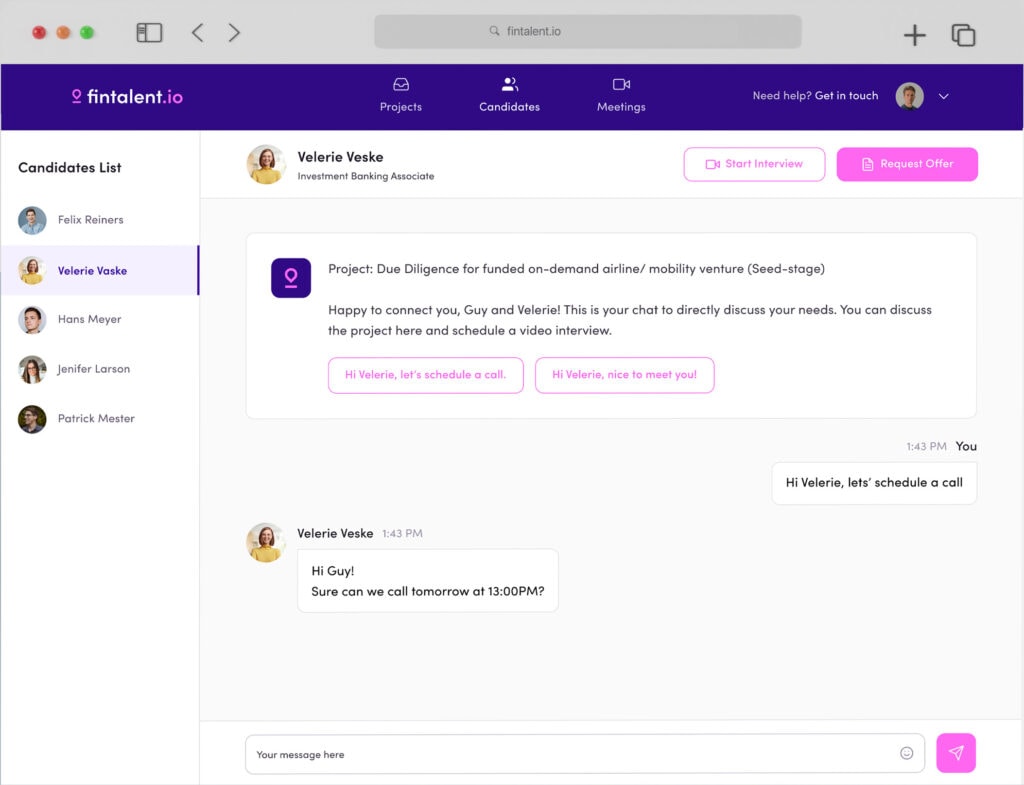

- Due diligence: Consultants can conduct thorough due diligence on target companies, assessing their financial performance, organizational structure, and potential synergies.

- Valuation and negotiation: Consultants can help companies determine the appropriate valuation for a target company and assist in negotiating the best possible deal terms.

- Integration planning: External consultants can assist with the planning and execution of post-merger integration, ensuring a smooth transition and the realization of synergies.

- Change management: Consultants can provide guidance on managing the cultural and organizational changes that often accompany M&A transactions.

What kind of skills does a market expansion consultant require?

A market expansion consultant requires several skills, including:

- Analytical skills: The ability to analyze complex financial and market data, identify trends, and draw insights is crucial for a market expansion consultant.

- Strategic thinking: Consultants must be able to develop and evaluate strategic plans for market expansion and M&A.

- Communication and presentation skills: Consultants need to effectively communicate their findings and recommendations to clients, often through written reports and presentations.

- Negotiation skills: Market expansion consultants must be skilled negotiators to help clients secure favorable deal terms in M&A transactions.

- Project management: Managing multiple projects and deadlines is a critical skill for a consultant working on market expansion initiatives.

- Industry knowledge: Consultants should possess deep knowledge of the industries they serve to provide tailored advice and guidance.