What is corporate development?

Corporate development refers to the strategic activities and initiatives undertaken by a company to grow and enhance its value. These activities may include mergers and acquisitions (M&A), strategic partnerships, joint ventures, divestitures, and other transactions aimed at creating synergies, expanding market share, or entering new markets. Corporate development is a key aspect of a company’s overall corporate strategy, which outlines the long-term objectives and the means to achieve them.

How can external consultants support corporate development?

External consultants can support corporate development in various ways, providing expertise and resources to help companies achieve their growth objectives. Some of the key areas where consultants can provide support include:

- M&A Strategy: External consultants can help a company develop a comprehensive M&A strategy that aligns with its corporate objectives. This may involve identifying potential target companies, assessing the value of a transaction, and advising on the structure and financing of deals.

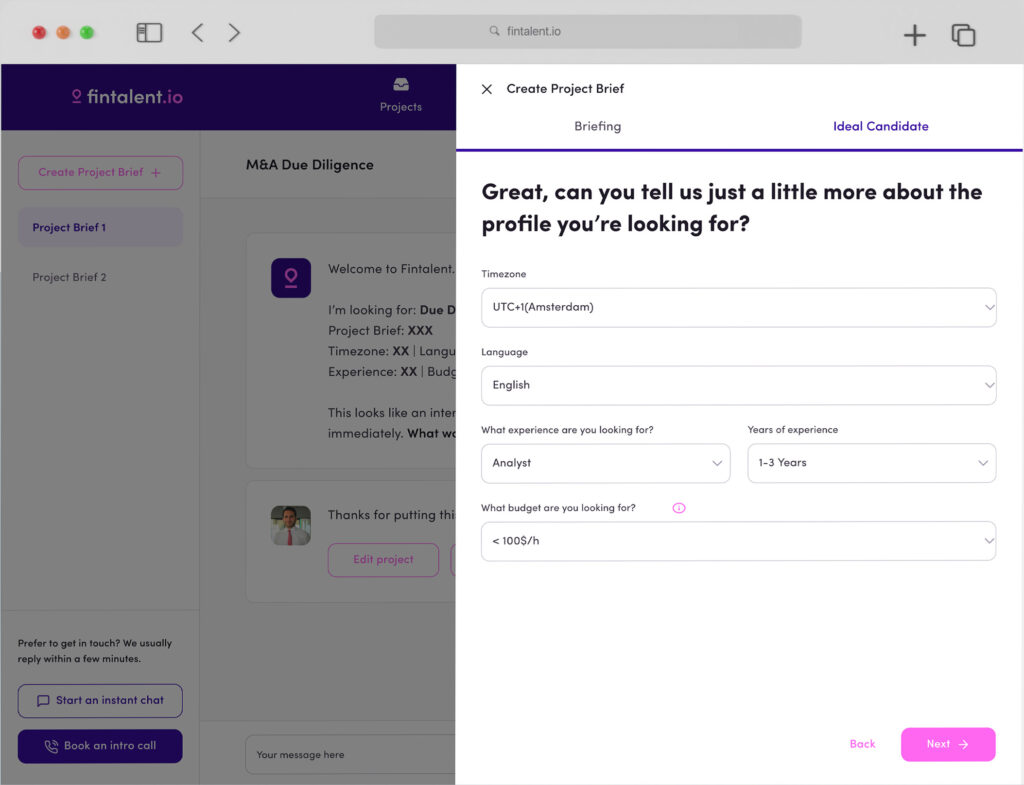

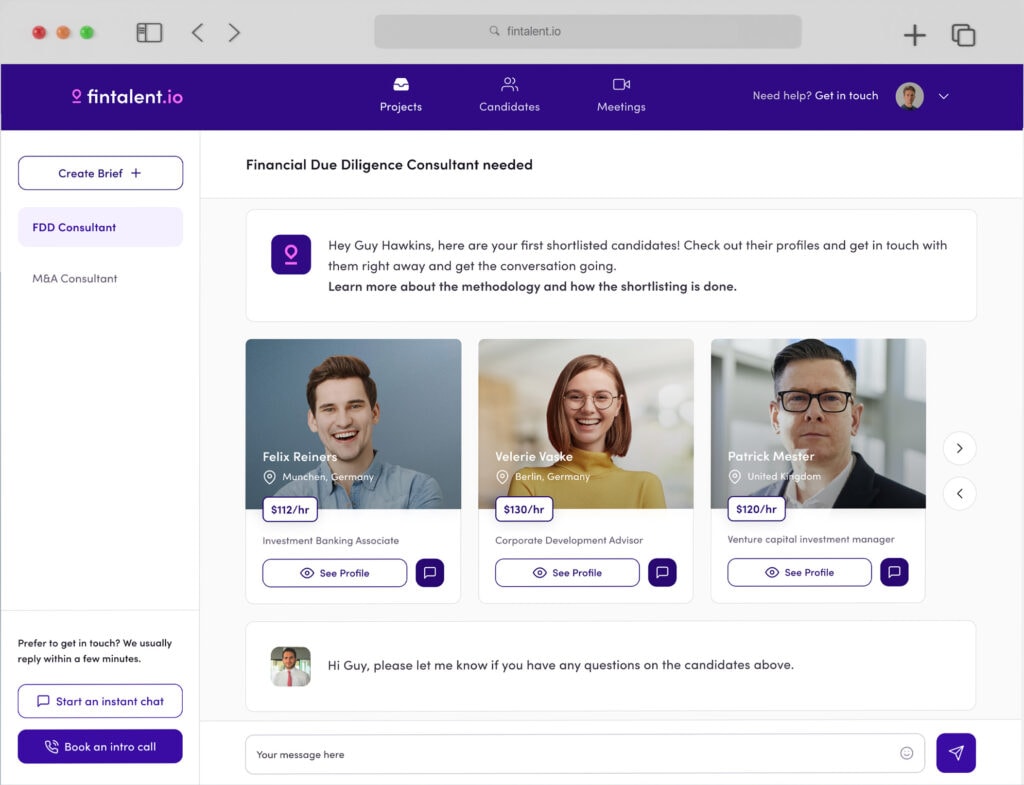

- Target Sourcing and Assessment: corporate development consulting can support the sourcing and assessment of potential M&A targets. They can help identify suitable companies based on specific criteria, conduct preliminary assessments, and evaluate the strategic fit with the client’s objectives.

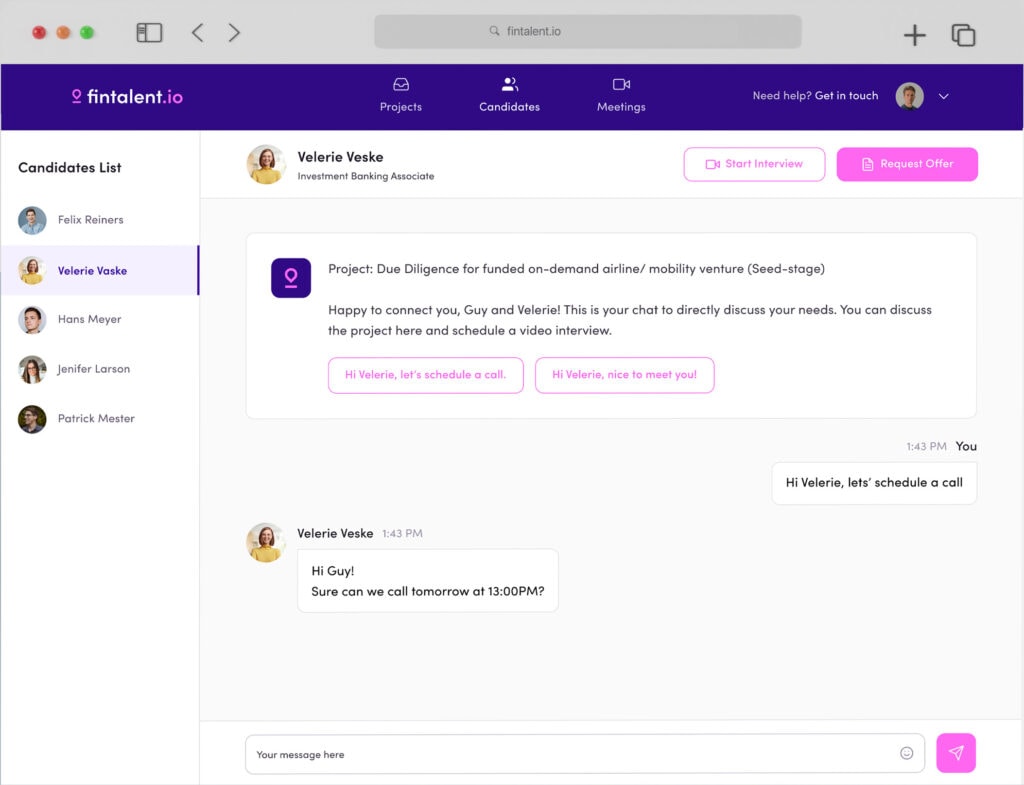

- Due Diligence: External consultants can play a crucial role in the due diligence process by conducting a thorough review of a target company’s financials, operations, legal, and regulatory compliance. This can help identify potential risks, uncover hidden liabilities, and evaluate the overall attractiveness of a deal.

- Project Management Office (PMO): Consultants can help establish and manage a PMO to oversee the various aspects of corporate development projects. This includes setting up the governance structure, defining project scopes and timelines, allocating resources, and monitoring progress.

- Post Merger Integration (PMI): External consultants can assist in the planning and execution of post-merger integration, ensuring a smooth transition and the realization of synergies. This may involve the integration of operations, systems, processes, and teams, as well as managing cultural and organizational changes.

What does a corporate development consultant do?

A corporate development consultant provides advice and support to companies undertaking strategic growth initiatives, such as M&A, divestitures, and partnerships. Their main responsibilities include:

- Developing M&A strategies: Consultants help clients formulate and refine their M&A strategies, considering factors such as industry trends, competitive landscape, and growth objectives.

- Identifying and assessing potential targets: Corporate development consultants work with clients to identify suitable target companies, evaluating their strategic fit and potential value.

- Conducting due diligence: Consultants assist in the due diligence process, reviewing target companies’ financials, operations, and other relevant aspects to ensure a sound investment decision.

- Negotiating deal terms: Corporate development consultants may help negotiate deal terms, ensuring that the transaction aligns with the client’s objectives and provides value.

- Overseeing project management: Consultants may establish and manage a PMO to coordinate and monitor the progress of corporate development projects, ensuring timely and successful execution.

- Supporting post-merger integration: Corporate development consulting assist in the planning and implementation of PMI, helping to realize synergies and manage organizational changes.

What is the relationship between corporate development, M&A, and corporate strategy?

Corporate development is a key component of a company’s corporate strategy, which outlines the long-term goals and objectives of the organization. Corporate development focuses on the strategic initiatives and transactions that enable a company to grow and enhance its value, such as M&A, partnerships, and divestitures.

M&A is a critical aspect of corporate development, as it involves the acquisition or merger of companies to achieve growth objectives. This can include expanding market share, entering new markets, gaining access to new technologies, or consolidating the competitive landscape. M&A transactions are typically guided by a company’s corporate strategy, ensuring that the deals align with its long-term goals and objectives.

The relationship between corporate development, M&A, and corporate strategy can be summarized as follows:

- Corporate strategy provides the overarching framework that outlines a company’s long-term goals and the means to achieve them.

- Corporate development focuses on the strategic activities and transactions that support the company’s growth objectives, such as M&A, partnerships, and divestitures.

- M&A is a key component of corporate development, involving the acquisition or merger of companies to achieve growth objectives in line with the company’s corporate strategy.

In essence, corporate strategy sets the direction for a company’s growth, while corporate development and M&A serve as important tools to help achieve those strategic objectives.