M&A, Transformation, And Strategic Finance Staffing Platform

Independent M&A, Transformation, And Strategic Finance Professionals – On Demand And Beyond.

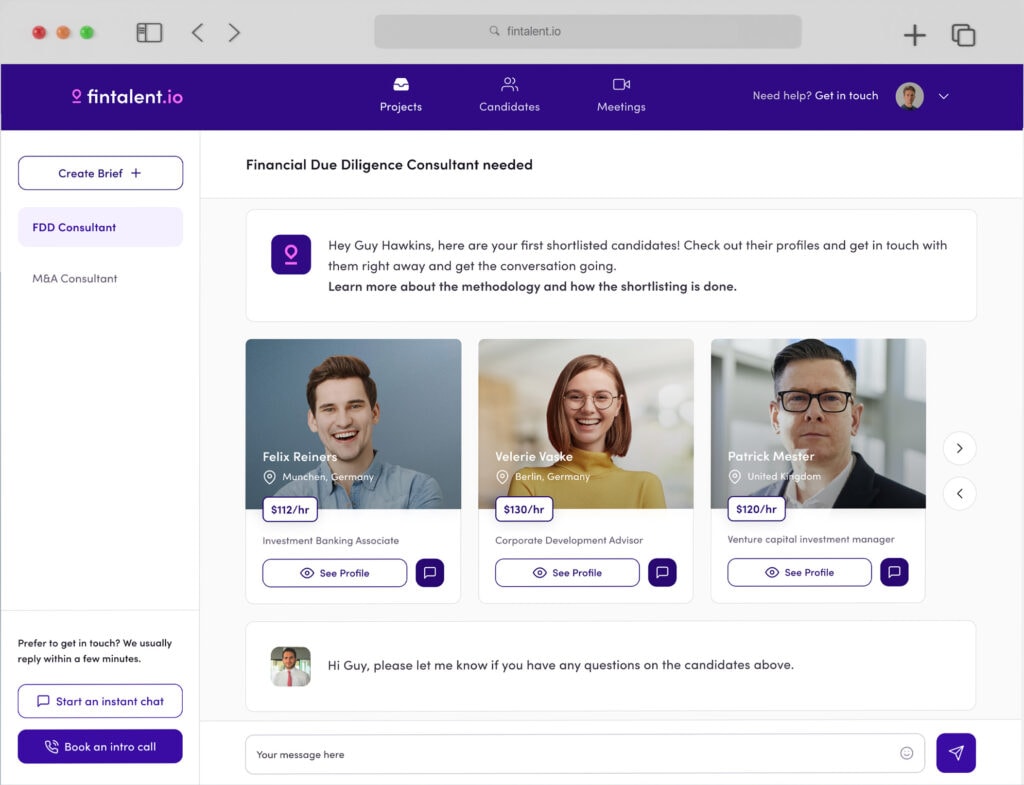

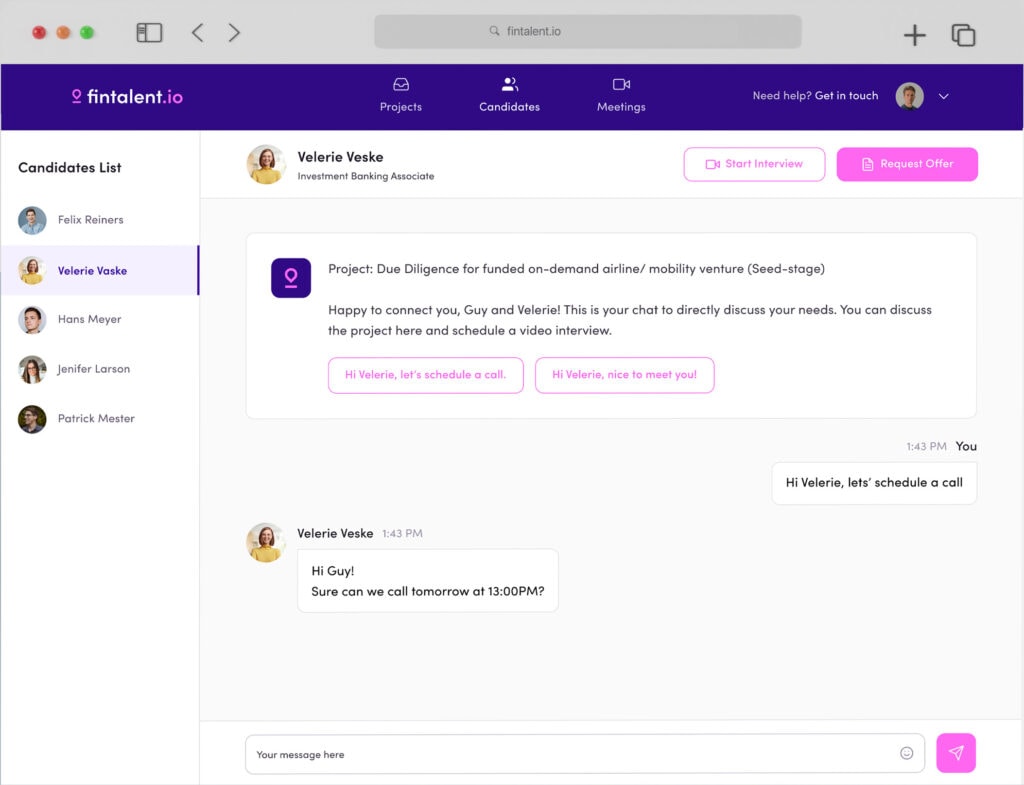

Fintalent.com connects you to a global network of 4,000+ vetted M&A, Integration, Transformation, and Strategic Finance professionals across 20+ industries. Our data-driven platform combines intelligent search with human expertise — helping you identify, engage, and deploy top professionals for freelance, interim, and permanent mandates.

Prefer to talk? Book a call.

- No signup fee

- Personal service

- No hidden costs

Leverage Specialized M&A and Strategic Finance Consultants.

Leverage Fintalent to execute global corporate disposals, carve-outs, and Exits.

Our Managed Services include:

- Strategic Advisory: Crafting and refining your M&A strategy to align with your long-term objectives.

- Transaction Execution: Cra Supporting you through every step of the deal, whether you're buying, selling, or merging.

- Sell-side Advisory: Expert guidance on divestments, corporate sales, and succession planning.

- Buy-side Advisory: Identifying and securing acquisition targets, including majority and minority stakes.

- Company Valuations and Opinions: Providing accurate and comprehensive valuation services.

- Distressed M&A: Navigating the complexities of high-pressure distressed M&A transactions.

Voices:

Inorganic growth is fundamental to our strategy. We were looking for a global partner to help us with our buy-side M&A projects, and found Fintalent. From first contact to project start took less than 2 weeks.

We look forward to discussing your business case with us.

Free Handbooks: Learn How Agile M&A Teams create more M&A value

How do you leverage freelancers for your M&A team? We’ve create two handbooks to guide you through the ins and outs of flexible talent for both M&A and PMI projects – how they work, pros and cons, and practical checklists and guidelines to get the most value out of your agile M&A team.

The Flexible Future Of Corporate Development

A practical guide on how Corporate Development organizations can leverage M&A freelancers to execute more buy-side deals, faster – with a lean and agile team.

The Path To PMI Mastery: Building And Staffing For Integration

A practical guide for first-time and serial acquirers on how external consultants support, lead, and deliver value in post-merger integration scenarios.

2024 M&A Software Landscape

We analyzed 100+ M&A software vendors, to create the most comprehensive picture of the status quo of M&A software.

Fintalent provided an M&A freelancer for one of our latest corporate M&A projects. The support was incredibly fast, hands-on and of high quality and critical to advance the project we were not able to address with internal resources.

We needed an interim CFO to help put our fast-growing FinTech on the right track. I found a number of great candidates incredibly fast. We’ve now hired our Fintalent full-time!

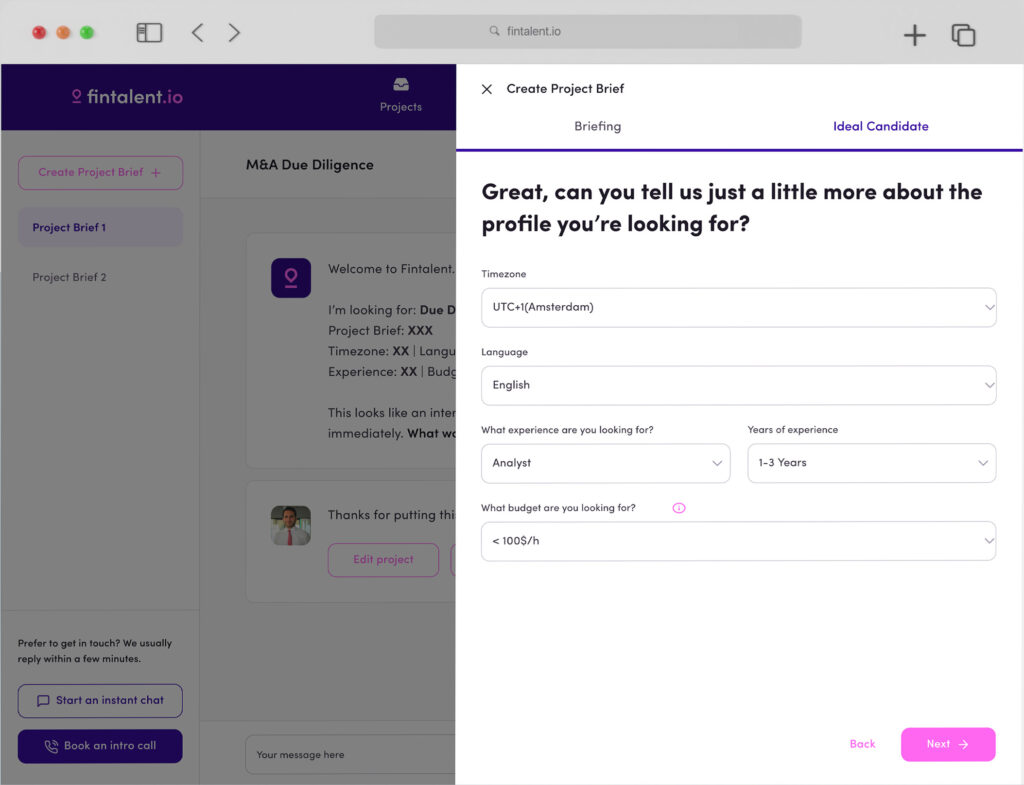

Connect with the right M&A Freelancer within Hours

Find Freelance Consultants in these categories

CFO Services & Growth Capital

Business plan

Capital Raising

Corporate Finance

Financial Planning & Analysis (FP&A)

Forecasting

Fractional CFO

Fundraising

Interim CFO

Interim Head of Finance

IPO

Pitch Deck

Pre-IPO Advisory

Private Equity

Strategic Controlling

Strategic Finance

Succession Planning

Venture Capital

Virtual CFO

Due Diligence & Financial Modeling

Accounting

Business Valuation

Commercial Due Diligence

Financial Analyst

Financial Due Diligence

Financial Modeling

Information memorandum

Intellectual Property Valuation

LBO Modeling

M&A Marketing Material

Operational Due Diligence

Technical Due Diligence

Transaction Advisory

Vendor Due Diligence

Recently Posted Projects

Senior M&A Consultant to Support Sellside Process in Waste Management Sector

M&A Analyst – Strategic Execution for Corporate Buy and Build Projects

Experienced M&A Executive for Complex $600m International Acquisition

On-Site

$100 - 200

11 - 50 Years of Experience

German-speaking Consultant to support Financial Due Diligence & Business Plan Review

Belgian Freelance FDD Expert for SaaS Financial Evaluation Engagement (Start Date: Immediate - within 1–2 weeks)

Senior M&A Advisor for Acqui-Hire of Innovative AI SaaS Company

Interim Financial Analyst for Portfolio Review & Minority Equity Raise (Start: ASAP)

German Speaking Senior M&A Consultant for Sell-Side Transaction Execution in SaaS & Software Markets

Europe-based M&A Consultant for Thermal Power Acquisition (Start ASAP)

Interim Corporate Strategy Consultant for a PE-backed Company Engagement

Reclaim your freedom.

Sign up as M&A Freelancer.

- Join 4,000+ other vetted Fintalents on the largest platform for independent M&A consultants.

- Find exciting projects and decide where and when you want to work on M&A deals.

- Message and connect with other community members and build your own neo M&A boutique.