The term “LBO” is short for “leveraged buyout,” which is the process of buying a company with borrowed money. A leveraged buyout can be thought of as being similar to renting a house. The renter may have only paid 40% up front, but then had to pay that amount plus another 10% per month in order to cover the mortgage. In that example, the renter would have made 40% on their investment when they sold it at 80%. Similarly, an investor in an LBO might only put 20% of their own funds (or less) into the purchase while borrowing the remaining 80%. Then, the investor is able to make 80% (or more) on their investment when they sell it at 100%+ return.

LBOs are perceived as one of the riskiest forms of investing because they require large amounts of debt, which can greatly increase liability. This makes LBOs especially risky during times of economic weakness or recession where businesses are reluctant to buy “credit” or are less capable of paying off loans – often causing them to default on them. However, if an LBO is successful, it could be very lucrative for investors.

An LBO is often used in the private equity or venture capital context. Investors in these ventures hope that successful companies will eventually become publicly traded and thus be able to pay off the debt taken on by the investors and their backers.

What are the types of LBO?

There are two main types of LBOs: “leveraged” and “un-leveraged”. In a leveraged buyout, the company takes on large amounts of debt that is typically one and a half (1.5) to four (4) times its EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). To give an example, if the company has $1 million in EBITDA, it may take on $2.5 to $7.5 million of debt. The ratio of debt to equity in an LBO is typically around 3:1. A leveraged buyout can be seen as a way that some companies go out of business if they are unable to pay their debt back – see also bankruptcy (the process by which some companies go out of business).

In addition to the debt taken on for the acquisition, there are typically refinancing activities that occur after the acquisition takes place. These activities involve new loans for existing debt or new equity put into the company by its new owners.

Process of an LBO

The process of an LBO can be broken down into two stages: asset acquisition and company restructuring/financial engineering.

- Asset Acquisition: This stage focuses on acquiring assets such as real estate, products, intellectual property, stakes in other companies, etc.

- Company Restructuring: This stage focuses on restructuring the company to reduce debt (and thus increase profitability), while at the same time attempting to maintain the intellectual property of the company while making it more profitable. These steps might include layoffs, sale of non-core assets, etc.

The process by which an LBO generates funds for its investors is known as asset extraction. Groupthink among the shareholders and management of the company being acquired plays a key role in this. In an LBO, large sums of debt are often taken on by investors before being distributed. This debt is typically used to purchase assets from the company being bought out, while some firms may have additional debt rolled into new loans to help finance the acquisition. Investors often take on a type of financing known as a subordinated debt instrument in which a lower interest rate or a longer term is offered on some of the debt. The payoff from these arrangements can be spectacular for investors if they become successful companies.

Typically, the company being taken over will obtain a new management team and board of directors. These individuals take on a senior debt position to help finance any remaining equity needed for the acquisition, and they often receive equity in their new organization as well.

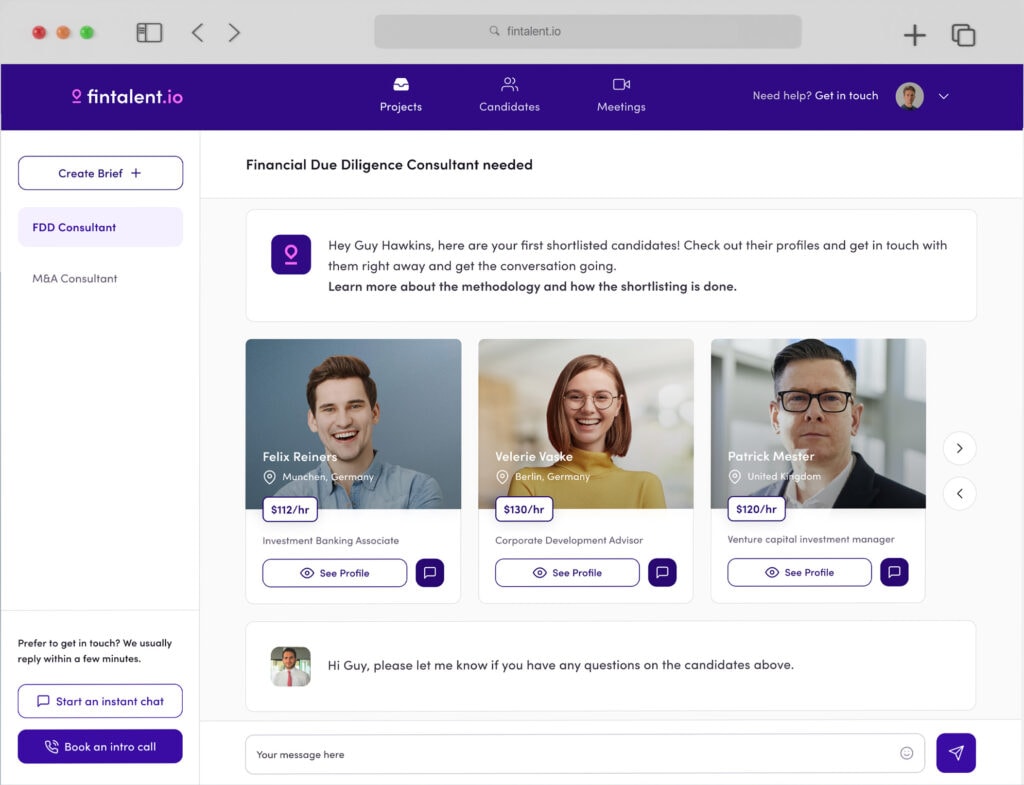

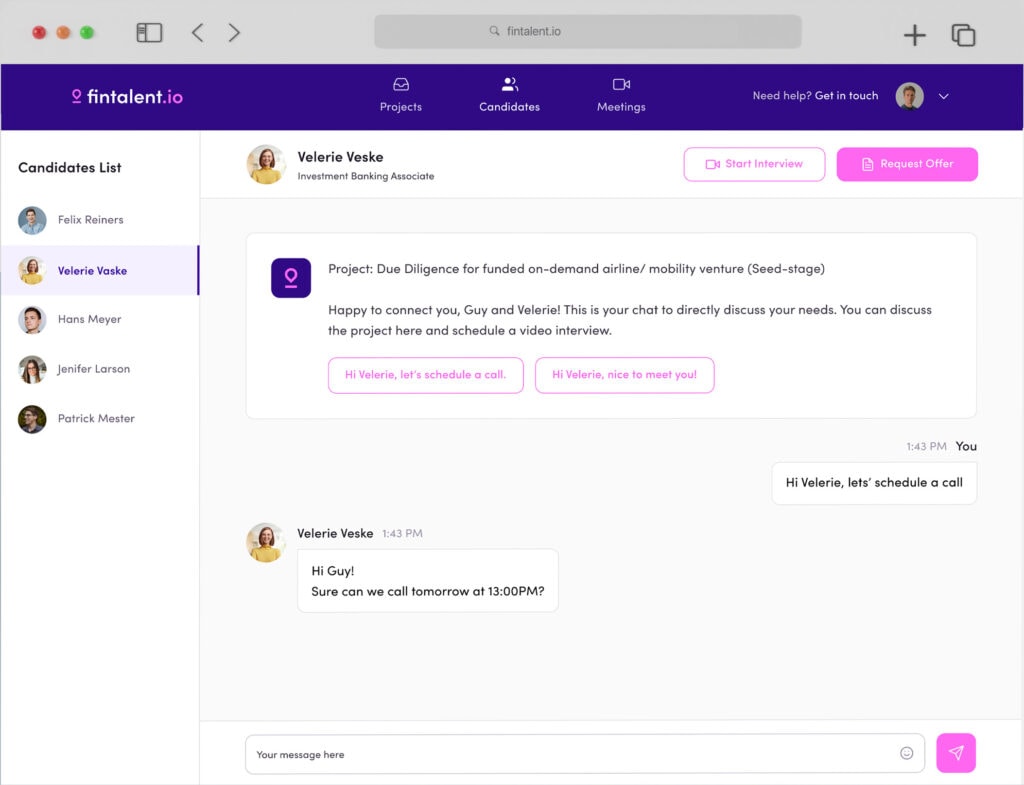

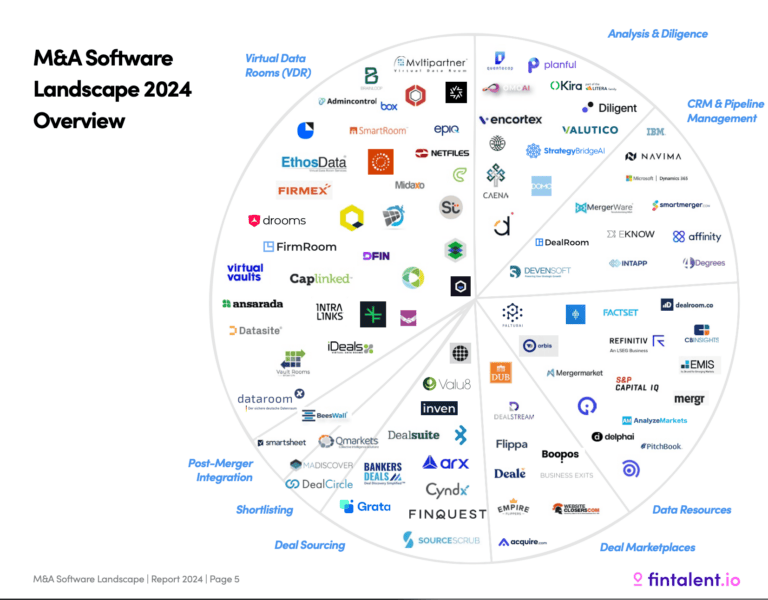

The primary factor in financing an LBO is debt, which is usually very high due to using debt to buy out companies (i.e., leverage). However, other factors come into play as well. The amount of cash needed depends on the size of the leveraged buyout and how much money the company has at its disposal prior to being acquired. The amount of debt needed depends on the capital structure of the business. In order to ensure a successful LBO it is worth seeking the advice of venture capital consultants.

When an LBO is completed, it often becomes involved in accounting transactions, which also involves financing companies. An LBO can also give rise to share buybacks, which are ways for shareholders to buy stock, usually at a discount compared to what it would be worth if sold in the open market.

There is generally less awareness in the public arena in general about LBOs than there is with other forms financing, which makes professional guidance from private equity consultants somewhat indispensable for an investor that wishes to go this route.