Business valuations are essential for various purposes, such as raising capital, mergers, and acquisitions, exit planning, or estate planning. Understanding the fundamentals of business valuation can help business owners make informed decisions and maximize their company’s value. This guide will provide an introduction to business valuations and discuss how external consultants can play a vital role in the process.

Understanding Business Valuation

What is Business Valuation? Business valuation is the process of determining the economic value of a company. It involves analyzing a company’s financial performance, industry trends, competitive landscape, and growth prospects. The valuation process helps owners, investors, and other stakeholders make informed decisions about the company’s worth.

Key Valuation Methods: There are several methods used to value a business. The most common approaches include:

-

Asset-based valuation: This approach calculates the net value of a company’s assets minus its liabilities. It is most suitable for asset-heavy businesses or companies in the liquidation process.

-

Income-based valuation: This method focuses on a company’s ability to generate future income. The most common income-based approach is the Discounted Cash Flow (DCF) analysis, which estimates the present value of a company’s future cash flows.

-

Market-based valuation: This approach relies on comparing the company to similar businesses in the market. Common market-based valuation methods include the trading comparables analysis and the precedent transaction analysis.

Preparing for a Business Valuation

Financial Documentation: Gather all relevant financial documents, such as balance sheets, income statements, and cash flow statements. These documents will be crucial in determining the company’s financial performance and overall health.

Industry Analysis: Understand the industry in which the company operates, including trends, growth drivers, and potential risks. This information will help in assessing the company’s performance relative to its competitors and determining its market position.

Choosing a Valuation Method: Select the most appropriate valuation method based on the company’s characteristics and the purpose of the valuation. Consider factors such as the nature of the business, the availability of financial data, and the preferences of potential investors or buyers. Commonly, discounted cash flows are used to value a business.

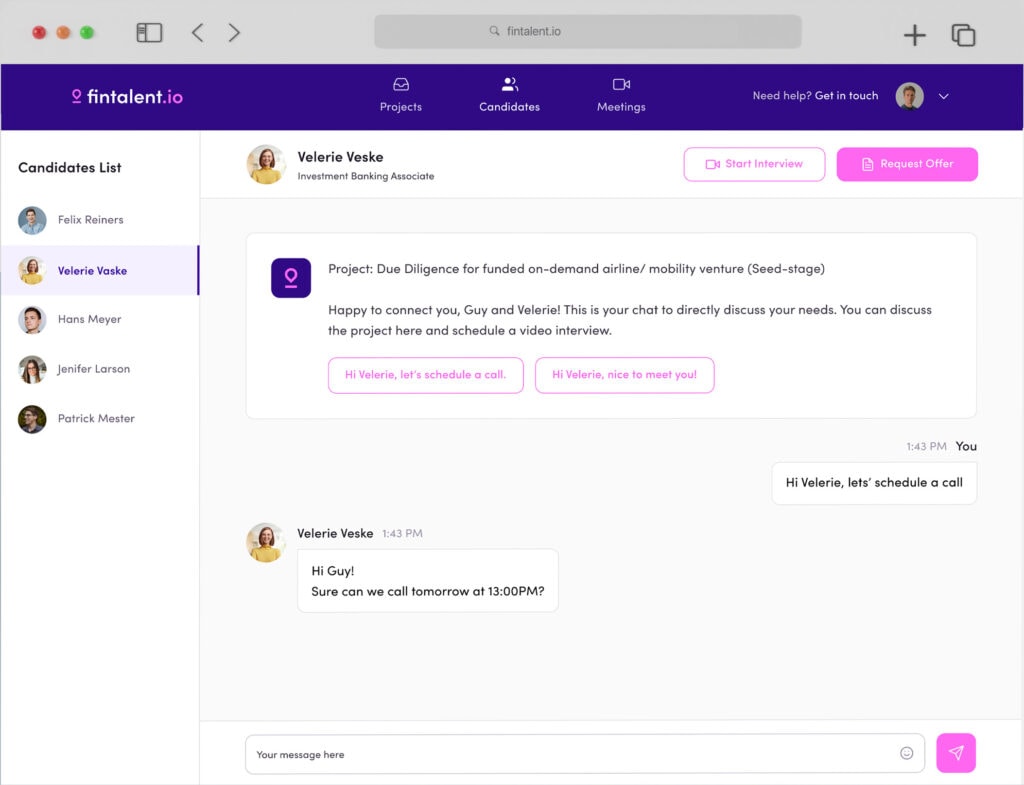

Leveraging External Consultants for Business Valuations

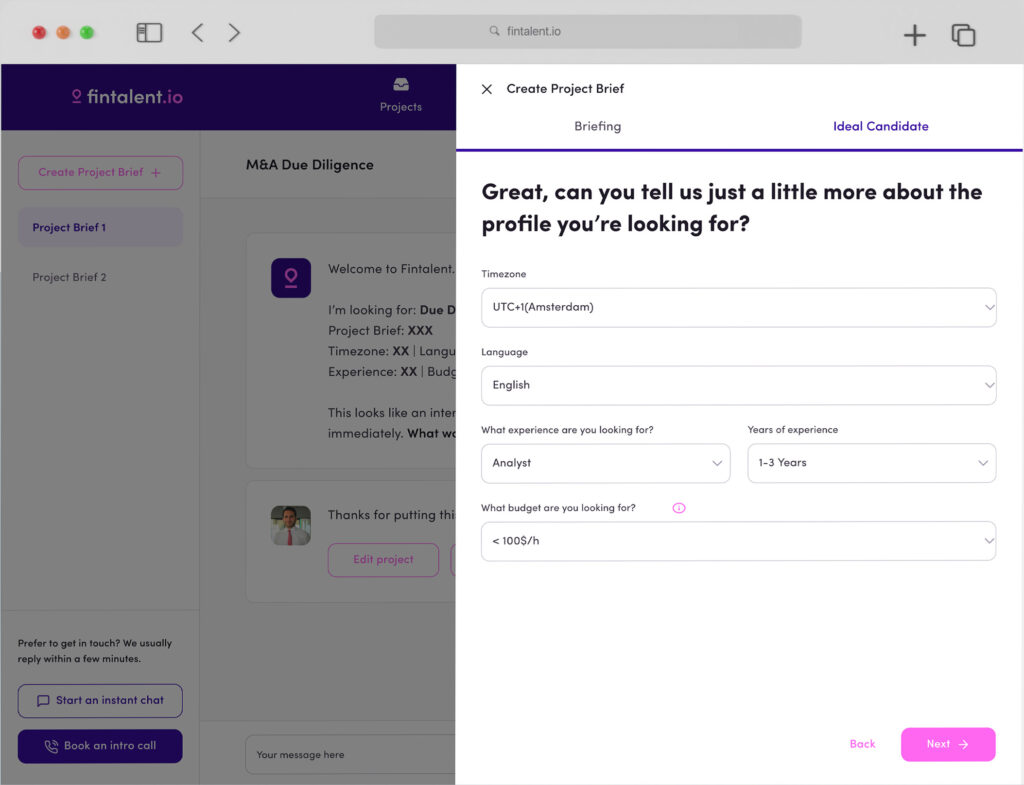

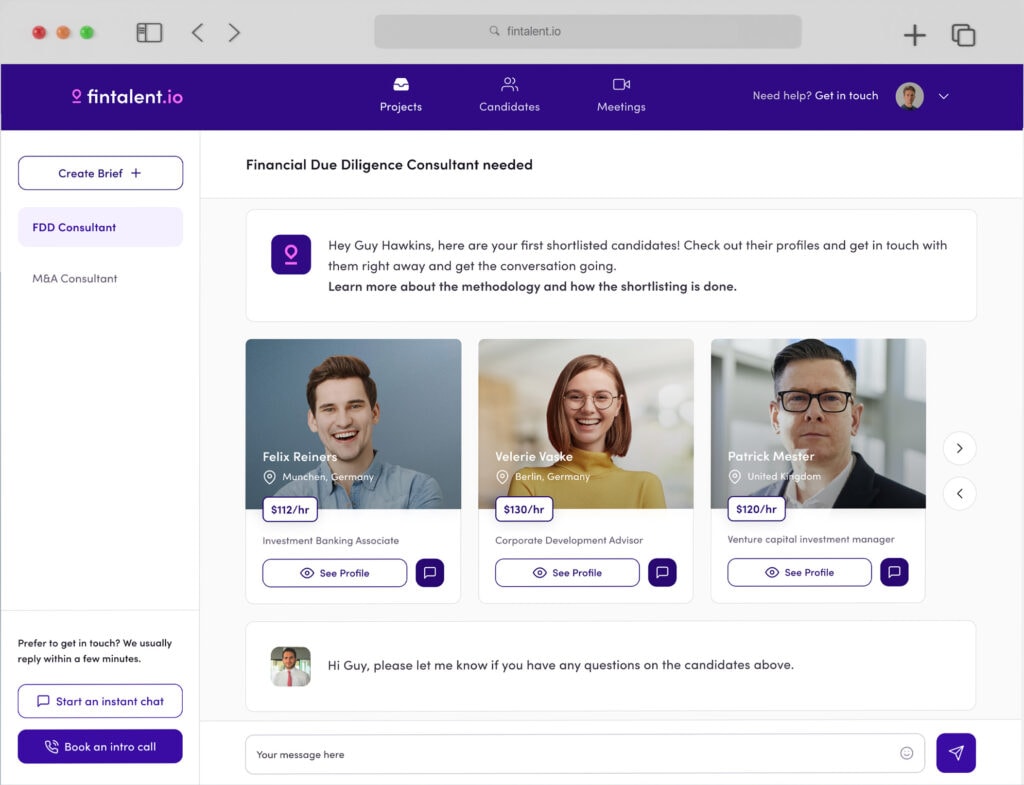

Why Engage External Consultants? External consultants bring valuable expertise, experience, and an unbiased perspective to the valuation process. They can help ensure the accuracy and credibility of the valuation, identify value-enhancing strategies, and provide guidance on transaction structuring.

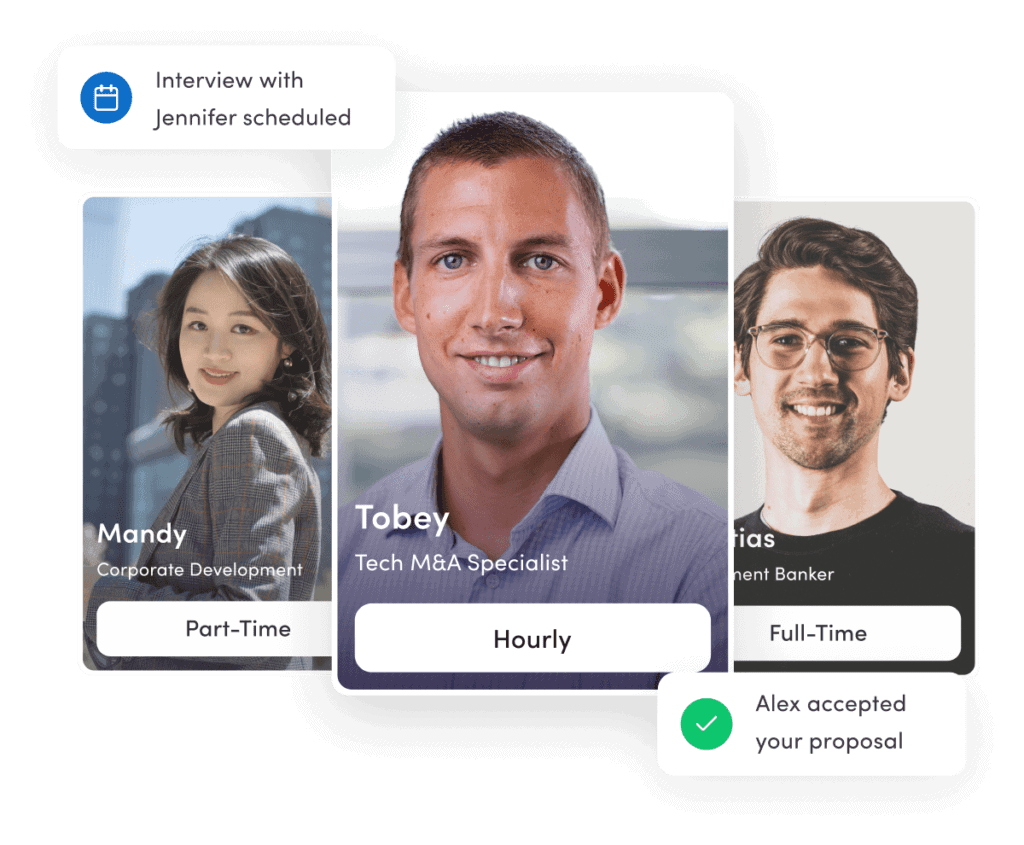

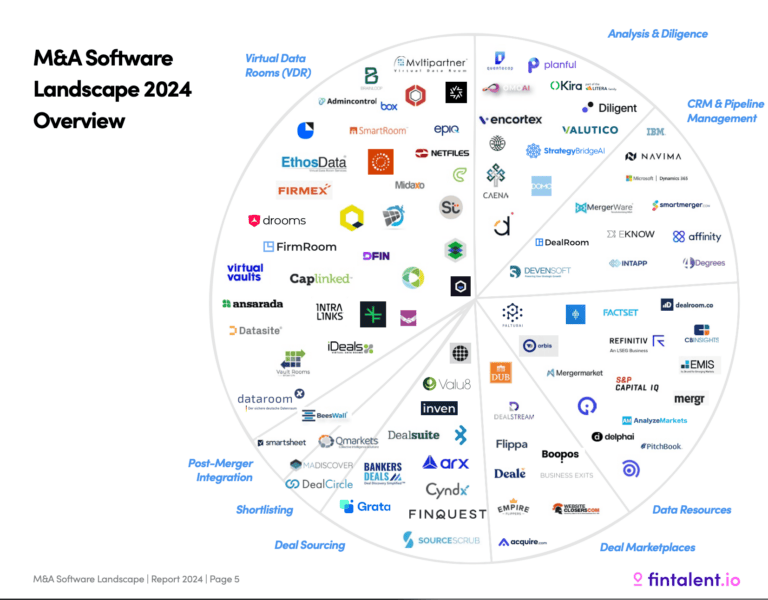

Finding the Right Consultant: To find a suitable consultant for your business valuation, consider their industry experience, credentials (such as the CFA or ASA designation), and track record of successful engagements. Ask for recommendations, search online, or consult industry associations to identify potential consultants.

Benefits of Engaging External Consultants

External consultants can provide several benefits in the business valuation process, such as:

-

Improved accuracy: Consultants can help ensure that the valuation is based on accurate data and realistic assumptions, reducing the risk of over- or under-valuing the business.

-

Enhanced credibility: A valuation conducted by a reputable external consultant can add credibility to the process, making it more attractive to potential investors or buyers.

-

Value optimization: Consultants can help identify strategies to enhance the company’s value and position it for a successful transaction or investment.

-

Time and resource efficiency: Engaging external consultants can save business owners time and resources by streamlining the valuation process and reducing the risk of errors.

Conclusion

Business valuations are essential for making informed decisions about a company’s worth and future potential. By understanding the fundamentals of business valuation and leveraging the expertise of external consultants, business owners can optimize their company’s value and achieve better outcomes in various transactions and investment opportunities.