Divestitures are a crucial aspect of corporate strategy, often undertaken to refocus the business, achieve better efficiencies, or satisfy regulatory requirements. A consultant specializing in divestiture advisory services plays a critical role in facilitating these transactions, ensuring they are executed effectively and achieve the desired results. This guide provides an in-depth understanding of the divestiture process, its relation to mergers & acquisitions (M&A), corporate development, carve-outs, private equity, and other related aspects. It also offers a roadmap for choosing the right consultant to meet your organization’s needs in divestiture consulting services.

What are divestitures?

Divestitures are transactions in which a company sells or transfers assets, subsidiaries, or divisions to another party. They are closely related to M&A activities, as both involve the transfer of ownership and control of business entities. While M&A transactions typically involve the acquisition and integration of companies, divestitures focus on the separation and sale of specific parts of a business. In both cases, the primary goal is to create value for shareholders by optimizing the company’s operations and resources.

Divestitures and Corporate Development

Corporate development encompasses the strategic decisions and activities aimed at creating long-term growth and value for a company. Divestitures are a key component of this process, as they enable organizations to reallocate resources and focus on core competencies, strategic goals, and high-growth areas. A well-executed divestiture, guided by a corporate divestiture expert, can lead to improved profitability, increased shareholder value, and enhanced organizational agility.

Divestitures and Carve-Outs

Carve-outs are a specific type of divestiture in which a parent company sells or spins off a non-core business unit or subsidiary. Carve-outs can take various forms, including the sale of the business to a third party, a spin-off into a separate publicly-traded company, or a management buyout. The primary objective of a carve-out is to create a more focused and efficient organization, which in turn can unlock value for shareholders.

Divestitures and Private Equity

Private equity firms are frequent participants in divestiture transactions, as they often seek to acquire undervalued or underperforming assets that can be restructured and sold for a profit. Divestitures present opportunities for private equity firms to leverage their expertise in operational improvement, financial engineering, and market positioning to create value in the acquired businesses.

Identifying Your Divestiture Consulting Needs

Before selecting a divestiture consultant, it is crucial to identify your organization’s specific needs and objectives. This requires a thorough understanding of the business and its strategic goals, as well as an assessment of the potential benefits and risks associated with the divestiture. Key considerations include:

- The rationale for the divestiture (e.g., regulatory compliance, improved operational focus, debt reduction)

- Desired transaction structure (e.g., carve-out, spin-off, management buyout)

- Impact on the remaining organization

- Timelines and key milestones

- Potential buyers or partners

Selecting the Right Divestiture Consultant

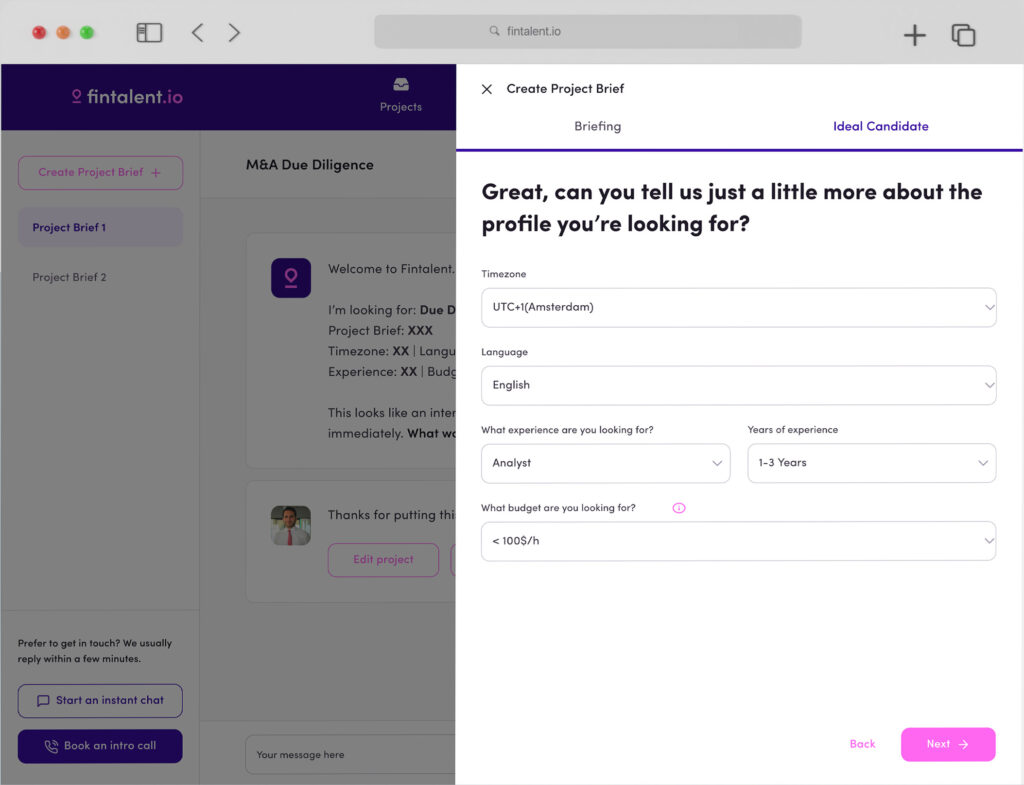

Once you have a clear understanding of your divestiture needs, it’s time to choose a consultant who can effectively guide you through the process. Factors to consider when selecting a divestiture consultant include:

- Relevant experience and expertise in your industry

- Track record of successful divestitures and carve-outs

- Strong network of potential buyers, investors, and strategic partners

- Understanding of the regulatory landscape and potential risks

- Financial and operational analysis capabilities

- Proven project management skills and ability to meet deadlines

To evaluate potential consultants, consider requesting proposals, conducting interviews, and seeking referrals from industry peers or professional associations.

Best Practices for Working with a Divestiture Consultant

To ensure a successful collaboration with your divestiture consultant, keep the following best practices in mind:

- Establish clear expectations: Clearly communicate your objectives, desired outcomes, and timelines to ensure alignment between your organization and the consultant.

- Foster open communication: Encourage regular updates and maintain open lines of communication throughout the divestiture process.

- Provide necessary resources and support: Ensure your consultant has access to the information, personnel, and resources needed to effectively execute the divestiture.

- Monitor progress: Regularly review the progress of the divestiture against key milestones and address any issues or concerns promptly.

- Be flexible and adaptive: Divestitures can be complex and unpredictable, so be prepared to adjust your approach as needed to navigate unforeseen challenges or opportunities.

Conclusion

Divestitures play a significant role in shaping a company’s strategic direction and can unlock substantial value when executed effectively. By understanding the relationships between divestitures, M&A, corporate development, carve-outs, and private equity, you can better identify your organization’s specific needs and select the right divestiture consultant to help achieve your objectives. By following best practices for working with a divestiture consultant, you can ensure a successful collaboration and maximize the value of your divestiture transaction.