E-commerce Due Diligence is a fairly new discipline: Investments in e-commerce reached a stunning $103 billion in 2021 (compared to $30 million in 2016) making it one of the largest verticals in technology investments. E-commerce includes a broad category of companies selling products or offering services online from direct-to-consumer (“DTC”) companies to marketplaces (e.g., Amazon, Etsy) and even cloud-based software providers (Shopify).

E-commerce companies have fundamentally different operating models compared to offline businesses. Instead of investing in high-street locations or new equipment, they spend budgets on online advertising and scalable IT infrastructure to bring more customers to their websites and improve user experience. Therefore, due diligence of e-commerce business requires different data and approaches.

The purpose of this article is to highlight key areas for due diligence of e-commerce companies based on the author’s experience.

E-Commerce Due Diligence: Framework

Comprehensive due diligence of an e-commerce target business includes the following components:

- Commercial Due Diligence

- Product

- Unit economics

- Supply chain

- Financial Due Diligence

- Revenue

- Costs

- Technology

- Legal

Except for Technology, the components may look similar to the ones for an offline business, however, they include different metrics and types of analysis to be conducted. Let’s go through these components one by one.

Commercial E-Commerce Due Diligence

Product

Product due diligence in e-commerce includes reading reviews, benchmarking ratings with alternative products and understanding the value proposition of each product, just like any new customer would do.

A successful e-commerce business should have a unique product portfolio with many positive customer reviews. For products sold on marketplaces, it is also important to understand if any review manipulations happened in the past because this would violate marketplace policies and considered a red flag.

For any similar product or service found online it is useful to understand who offers it and what is the strategy of the competitor. The competitors may be established offline brands aggressively entering online space. In online space undifferentiated products and services quickly face increased price competition, which eventually erodes margins.

Unit economics

Analysis of unit economics is crucial for e-commerce due diligence. In a nutshell, unit economics is just how much profit a company makes from each customer over its “lifetime” (referred to as Lifetime Value, or LTV) compared to how much it costs to acquire this customer (Customer Acquisition Cost, or CAC).

New customers in e-commerce come from paid channels (web search, social media, other referral platforms), or as organic traffic (direct visits to websites). In due diligence the investor should estimate overall CAC, including costs of each channel and how the company manages conversion of new visits into paying customers.

For example, a company spent $2,000 on a marketing campaign, which resulted in 10,000 new customers clicking on advertisement of the company’s product. Out of these 10,000 customers only 100 actually bought the product, i.e., the conversion rate is 1%. Then CAC is the $2,000 budget divided by 100 new paying customers, which gives us $20 per new customer.

LTV of the paying customers should be evaluated based on expected profits from future orders and churn rates. A healthy e-commerce business would have growing repeat orders over a long term. On the other hand, decreasing order values and/or frequencies combined with increasing churn rates signals that the company is attracting less valuable customers and its unit economics is deteriorating.

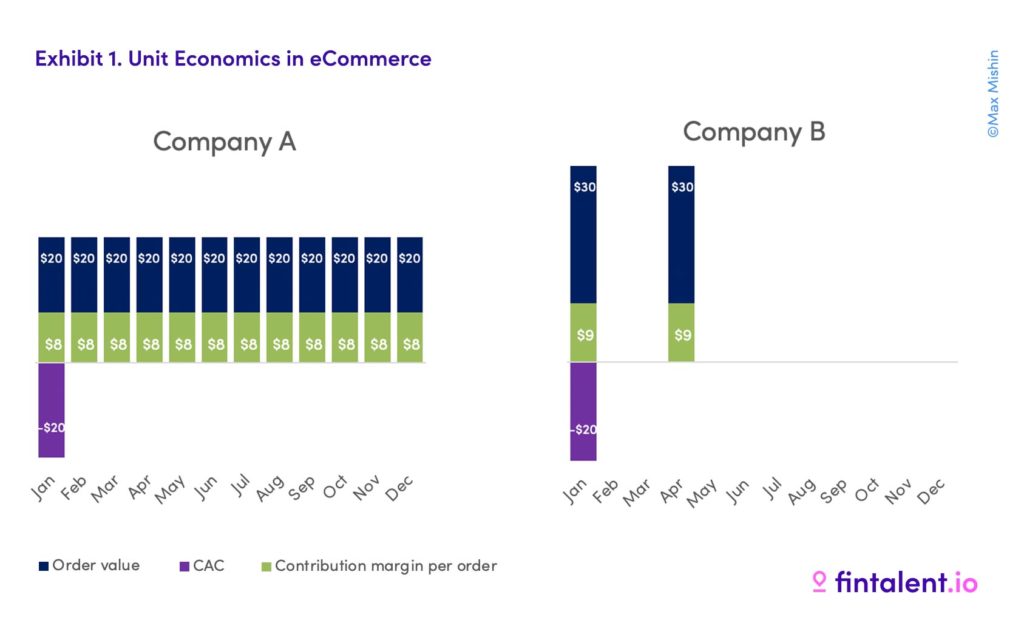

Continuing the example above, let’s now imagine that we have two companies A and B, which ran similar advertisement campaigns and each acquired 100 new customers at $20 CAC in January.

Company A’s customers on average spend $20 on its products each month, Company B’s – $30 per month. From the first look, Company B appears to have a more profitable business, but let’s dive deeper in the unit economics.

Company A’s acquired customers make orders monthly and have an average lifetime of 12 months, which is equivalent to 8.3% churn rate. Company A has a contribution margin of 40%, which means that each month Company A receives $8 in profits from each customer. Therefore, unit economics of Company A’s customers looks as presented on the left chart of Exhibit 1. LTV for Company A is its monthly profits of $8, divided by the churn rate of 8.3%, which gives us $96 per customer or 4.8x return compared on CAC.

Company B’s customers make orders less frequently – once in 3 months, and have an average lifetime of only 6 months, which is equivalent to 16.7% churn rate. The contribution margin is 30%, which means that each month Company B receives $9 in profits. Company B’s unit economics is on the right chart of Exhibit 1. LTV for Company B is its monthly profits of $9, divided by the churn rate of 16.7%, which gives us $18 per customer, which is only a 0.9x return compared to CAC. In other words, Company B burns money on its customer acquisition because new customers don’t bring enough profits during their lifetime.

Best practice is to analyze LTV and CAC in dynamics over the past 24 months on a monthly or quarterly basis for cohorts of customers, i.e., groups of new customers acquired in a specific month or quarter.

Supply chain

Not all e-commerce businesses manage supply chains of physical products, but this is relevant for online retailers.

Supply chain due diligence includes analysis of supplier diversification, logistics lead times and landed cost of products. Online retailers should have a reliable and cost-adequate supply chain which can quickly respond to fluctuations in online demand.

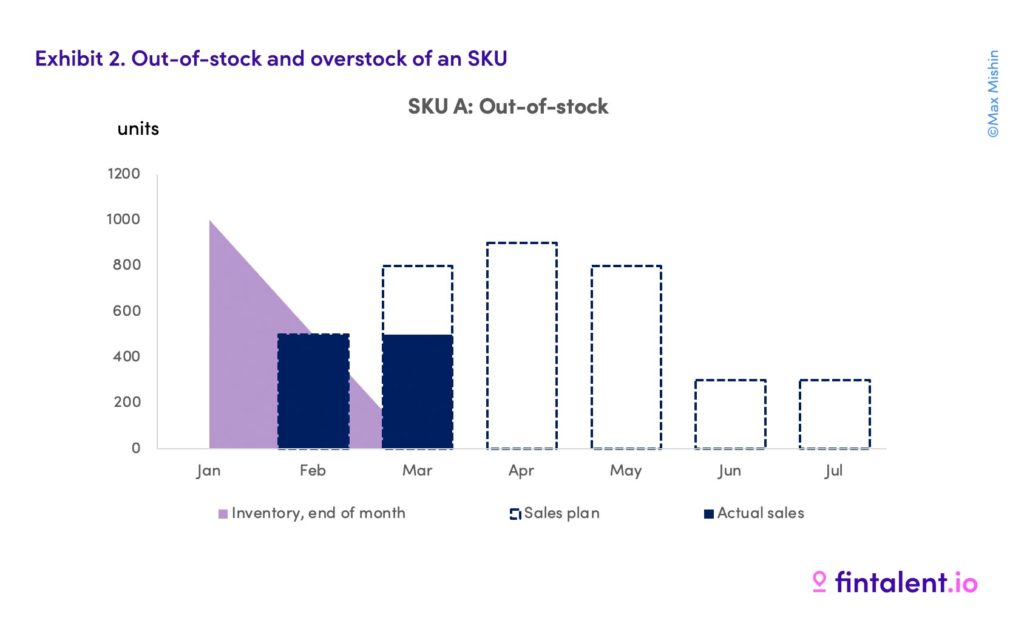

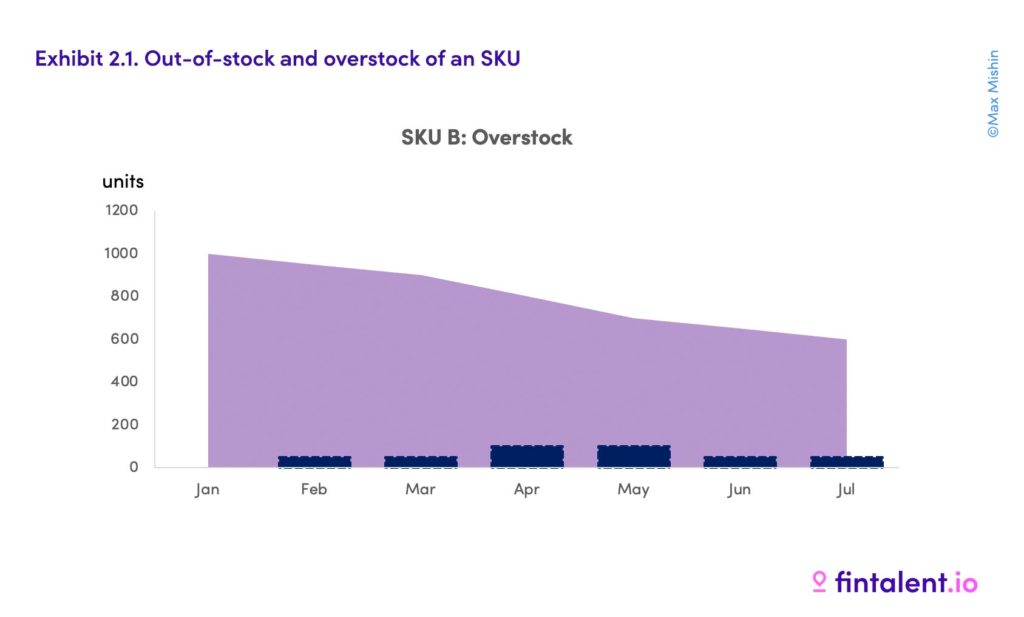

Additional issue is adequacy of current inventory levels to cover demand for the next 3-6 months. Holding insufficient inventory will result in lost sales due to out-of-stocks, while excess illiquid inventory incurs additional storage costs and freezes cash.

For example, let’s assume that target company has 1,000 units of SKU A as of the acquisition date in January. Expected sales of SKU A based on the same period last year is 500 units in February, 800 – in March, 900 – in April due to a seasonal spike. As you can see on the left chart of Exhibit 2, in this case, stock level of SKU A is not sufficient and the company will start losing sales and market positions already in March. This situation is called out-of-stock.

On the contrary, let’s assume that the target has 1,000 units of SKU B, but its expected sales amount to only 400 units over the next 6 months. In such case, the expected sales are fully covered with inventory, as presented on the right chart of Exhibit 2. However, stock of SKU B would be excessive because it will generate unnecessary storage costs. Such situation is call overstock.

Financial Due Diligence in e-Commerce

Revenue

The historical revenue of an e-commerce business can be validated based on transaction-level data from a marketplace or an accounting software of the target.

Revenue due diligence should provide insights into historical and future top-line growth drivers. This includes understanding the impact of seasonality, pricing and product mix changes, one-off events (such as out-of-stocks), and refunds/chargebacks levels.

An investor should also analyze revenue concentration by geography, product, customer or supplier. High concentration of revenue creates additional risk and should be investigated.

Costs

The main goal of due diligence is to confirm the amount of recurring business expenses, such as Cost of Goods Sold (COGS), marketplace fees, advertising, salaries, etc. Clear understanding of the cost base is required to confirm EBITDA of the business and negotiate valuation of the target.

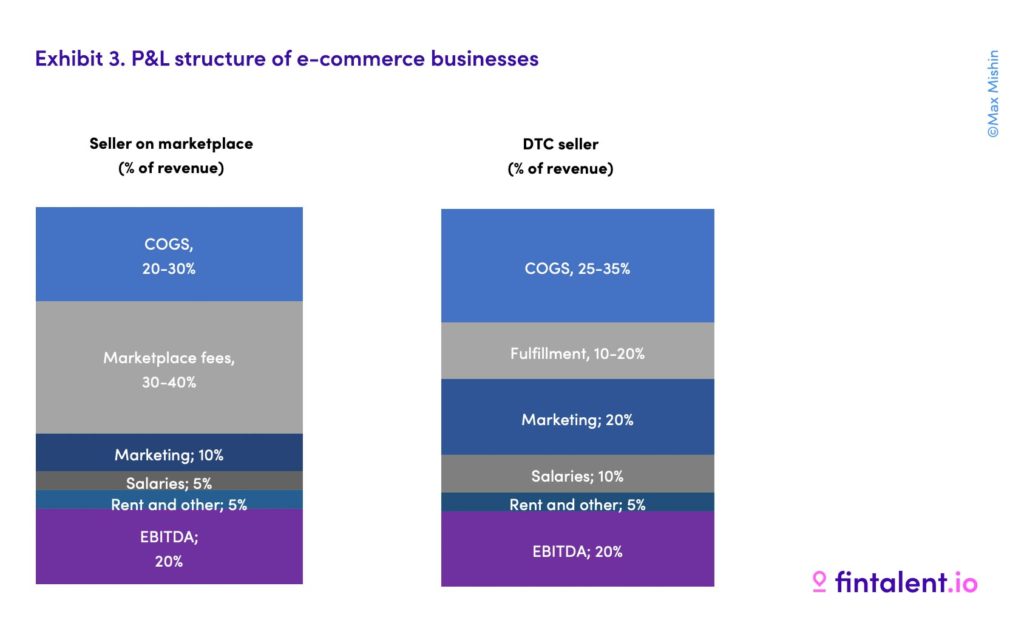

P&L structure will heavily depend on the type of a business model. For the purposes of this article, we will only compare P&Ls of a seller on marketplace platforms (e.g., Amazon) with a DTC seller. An example P&L structure for e-commerce business selling through a marketplace or own website is shown in Exhibit 3.

Exhibit 3. P&L structure of e-commerce businesses

COGS constitutes a large share of overall costs of e-commerce retailers – around 20-30% of revenue. This is usually a bit higher for DTC sellers – 25-35%. The goal of due diligence is to verify COGS based on actual paid invoices from suppliers, freight forwarders and 3PL warehouses.

A major cost item for retailers selling through marketplaces is marketplace fees, which amount to 30-40%, depending on the platform and product specifics. Marketplace fees can be validated based on data directly from marketplace platforms. It is important to pay attention to changes in fee levels to normalize these costs.

DTC sellers don’t have marketplace fees, but they incur fulfillment costs of 10-20% to deliver the orders. Fulfillment costs can be verified based on reports or invoices from fulfillment services providers.

Marketing expense for sellers on marketplaces is about 10% on average, while for DTC sellers it amounts to 20% because DTC retailers have to bring more traffic to their websites. Marketing expenses can be verified based on reports from advertisement platforms (marketplace, social media, search engines, etc).

Other expenses typically include salaries, office rents, insurance, software subscriptions and other items. Salaries tend to be higher for DTC compared to sellers on marketplaces, around 10% vs 5% respectively. This is because DTC retailers have to maintain its online stores and manage end-to-end logistics.

To verify other expenses, investors may look at bank statements, agreements or tax return forms. Transactions from bank statements have to be aggregated and matched with P&L lines to confirm historical numbers.

Technology Due Diligence

Despite that today investors in e-commerce have a fairly detailed understanding of key performance metrics to evaluate sustainability of such businesses, the area of technology due diligence remains overlooked, while it represents a major operational risk.

Technology e-commerce due diligence means conducting a professional assessment of the whole software stack and IT infrastructure of the target. For example, the target may have weak security protocols, which means high risk of ransomware attacks, or keep using an outdated tech infrastructure, which slows down business performance and will require additional capex for upgrades.

Legal Due Diligence

Legal due diligence should confirm that the target has valid and properly registered IP rights (trademarks, patents, code), agreements with third parties and employees, as well as ownership over its digital assets (domains, emails, accounts). Any identified issues ideally should be resolved before entering into the deal.

eCommerce Due Diligence: Checklist

E-commerce Due Diligence Checklist

Conclusion

E-commerce due diligence is not only focused on confirming financial and business plan numbers, but also requires buyers to look at more granular data (monthly CAC, LTV, cohorts) and focus more on defensibility of online market share through product differentiation, IP protection and solid technology.

The key to success here is engaging experienced due diligence professionals to support the investor during the whole process to ensure that all red flags are identified and have a mitigation plan. On the positive side, proper due diligence can help the buyer to identify opportunities for value creation and develop a business plan even before the deal is signed.